Introduction

In the rapidly evolving world of finance, where user engagement is paramount, employing innovative strategies is crucial. One of the most effective methods to captivate users is through gamification in finance. By integrating game-like elements into banking and finance applications, institutions can significantly enhance user experience, collect more leads, and boost retention. This article explores winning gamification ideas and strategies that can help boost retention and collect more leads on your banking and finance app and social media platforms.

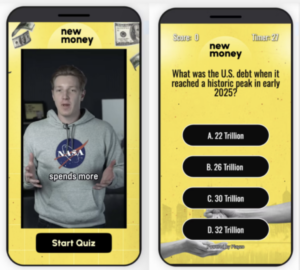

1. Quizzes with Rich Media

Quizzes are an excellent way to engage users while providing valuable information. By incorporating rich media such as videos and images, financial institutions can create a more immersive experience for users. For instance, a bank could design quizzes that educate users on financial literacy topics, investment options, or budgeting tips. The use of engaging visuals not only holds users’ attention but also makes learning about finance enjoyable.

This method can be implemented in various forms, such as:

- Interactive video quizzes that challenge the users on their knowledge right after a video tutorial on saving or investing.

By rewarding users with points or badges for completing quizzes, banks can encourage regular interaction with the app, thus improving retention rates.

2. Daily Word Puzzle Games

Word puzzle games like Wordle, Word Finder, and Connections have gained immense popularity due to their simplicity and engaging nature. Incorporating these games into a banking app can provide several benefits:

- Wordle: Create a daily word challenge that encourages users to guess financial terminology or concepts. This not only entertains users but also educates them on the vocabulary used in finance.

- Crossword: A crossword puzzle that incorporates relevant financial terms and scenarios can serve as a learning tool. Users can solve these puzzles while learning about new concepts, products, and services offered by the bank.

- Connections: Use this game to create associations between financial literacy concepts and real-life applications. This can help bridge the gap between theory and practice.

Such games can be refreshed daily to keep users returning to the app, driving engagement and retention.

Create Engaging Finance Games in Minutes

With Playzo, product managers can create these games themselves in minutes, allowing rapid deployment across platforms via a URL or embed code. This ease of use means that financial institutions can quickly adapt their gamification strategies based on user feedback or changing trends in the finance sector.

Additionally, Playzo facilitates SDK integration, allowing for seamless inclusion of these engaging games into existing banking apps without needing extensive technical knowledge. This empowers financial institutions to enhance their app’s interactivity and drive user engagement effectively.

Drive Retention and Collect More Leads

Engaging games serves as an effective mechanism for lowering churn rates in banking apps. Users who enjoy gamified elements are more likely to return to the app, explore new features, and ultimately remain loyal customers. Here are a few strategies to achieve this:

- Users are 2-3X more likely to provide their leads: email, and phone no. to participate in games or quizzes or to redeem rewards that they won by playing well

- Implement leaderboard systems where users compete against each other, further boosting participation & repeat engagement

- Offer rewards, such as discounts on banking fees or interest rate bonuses for users who engage with the game elements frequently.

- Create specific challenges aligned with financial goals, encouraging users to save or invest while competing for rewards.

Boost Brand Expertise with Educational Games

Gamification is not just about retaining users; it’s also an opportunity to enhance their financial literacy. Utilizing fun, interactive games can transform complex financial topics into easily understandable content. This approach builds trust between the financial institution and the user, establishing the brand as a credible source of financial knowledge.

By combining entertainment with education, banks can distinguish themselves from competitors while fostering a more informed customer base.

Conclusion

Incorporating gamification in finance is a creative solution that addresses the common challenges of user engagement and retention in banking apps. By implementing quizzes, word puzzles, and leveraging platforms like Playzo, financial institutions can create an engaging user experience that not only supports retention but fosters a more financially literate customer base. The future of banking lies in the ability to engage users through innovation and provide value beyond traditional banking services. Now is the time to embrace gamification to drive growth and success in the financial sector.