AI Summary

Discover the top seven gamification ideas for the finance industry that are proven to educate customers, simplify complex topics, and boost engagement. Using Playzo’s no-code gamification platform, financial institutions can increase customer trust, improve financial literacy, and generate more leads effectively in 2025.

Table of Contents

- Introduction: Why Finance Needs Gamification

- 1. Financial Literacy Quizzes

- 2. Investment Terms Crossword

- 3. Spin the Wheel for Customer Rewards

- 4. Budgeting Simulations & Savings Games

- 5. Daily Finance Wordle Challenge

- 6. Scratch Cards for Loan Offers & Discounts

- 7. Leaderboards for Financial Challenges

- Conclusion

- FAQ / People Also Ask

Introduction: Why Finance Needs Gamification

Financial services have traditionally struggled to make complex topics engaging. Banks and fintech companies often find it difficult to explain terms like credit scores, mutual funds, or retirement savings to customers in a way that keeps them interested. Gamification offers a solution by turning these intimidating subjects into interactive, enjoyable experiences. With Playzo, financial marketers and educators can use no-code game templates to teach, engage, and convert audiences without requiring technical skills.

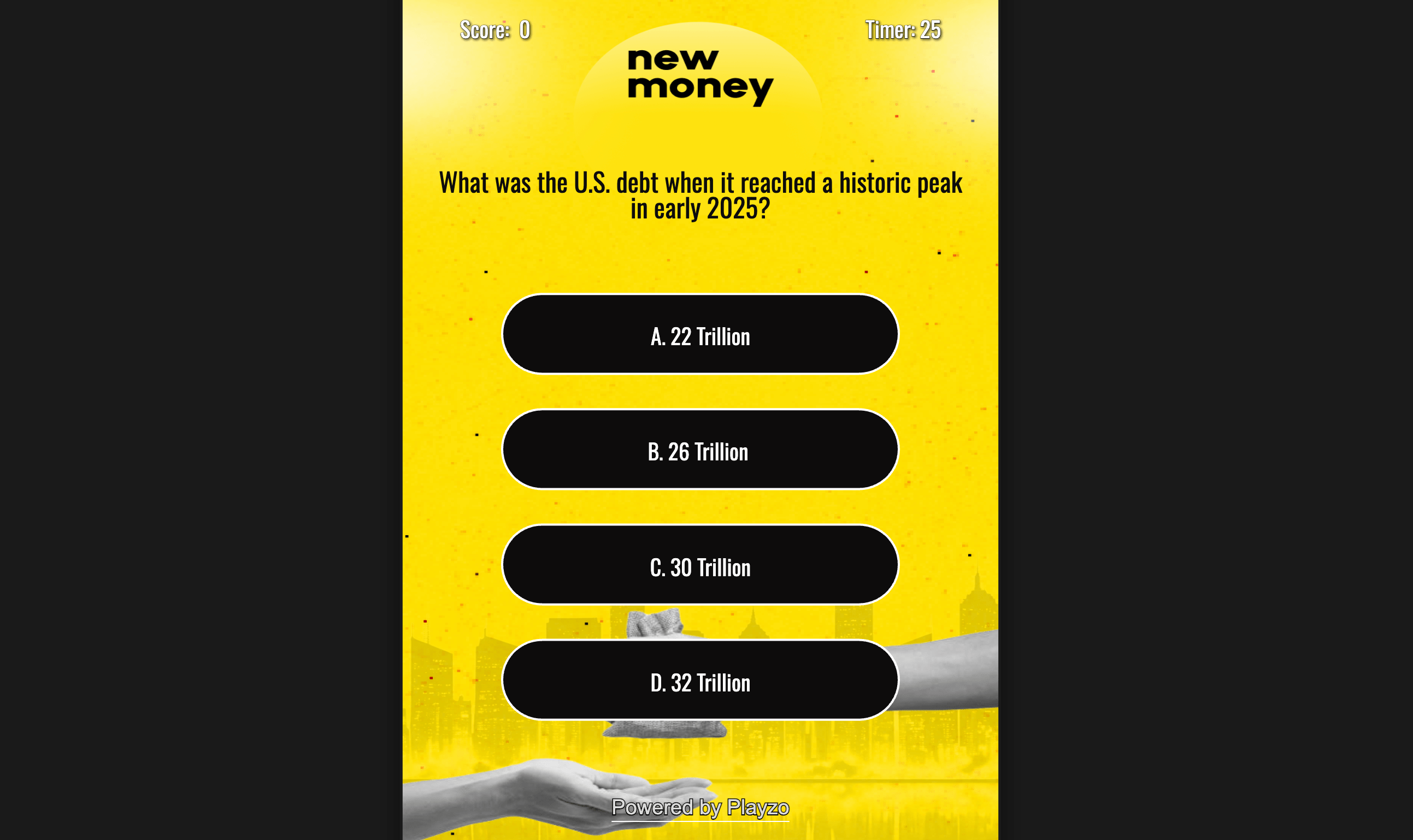

1. Financial Literacy Quizzes

Quizzes are one of the most effective methods for spreading financial literacy in an engaging way. Using Playzo’s quiz template, banks or fintech brands can test users on topics like credit, investments, or fraud prevention. Players not only learn through feedback but are also motivated by immediate scoring and rewards. This builds trust, positions brands as financial experts, and increases customer education while seamlessly collecting high-quality leads.

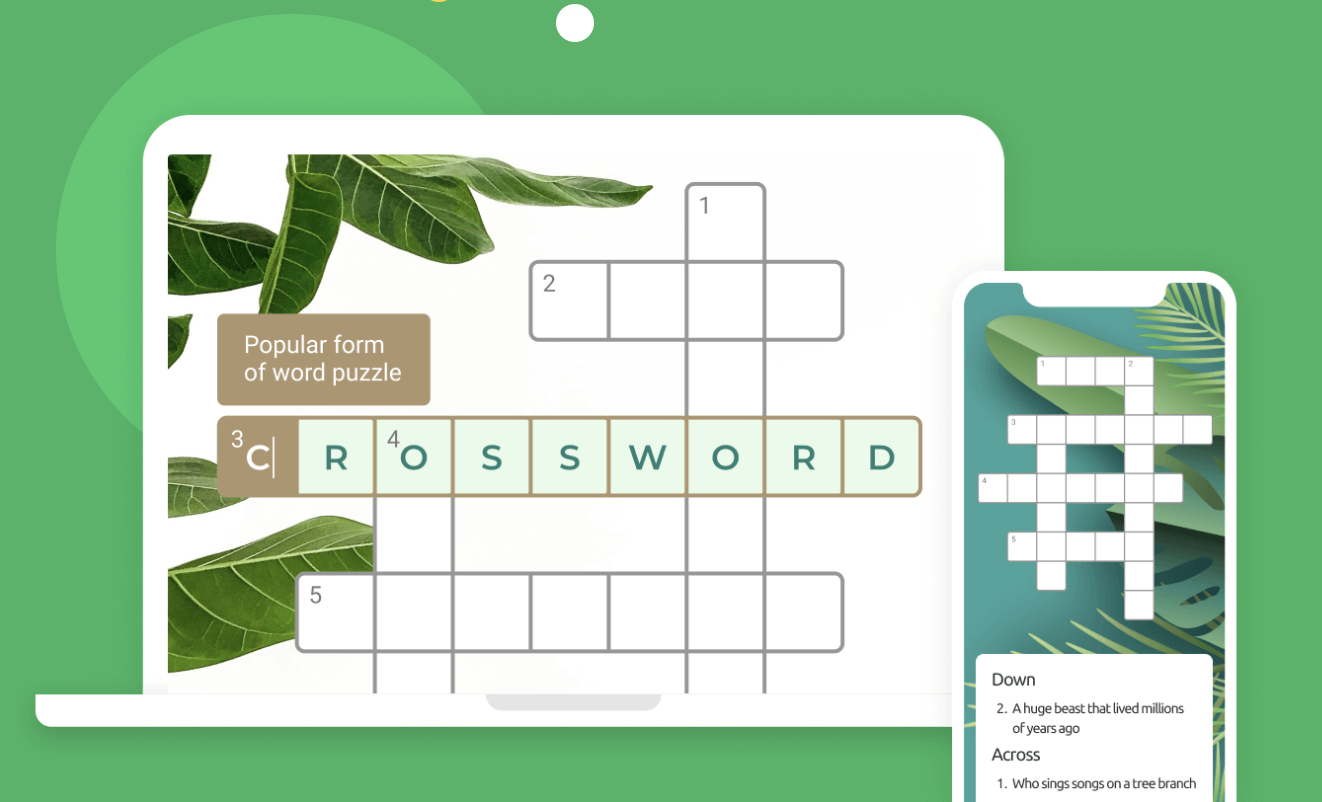

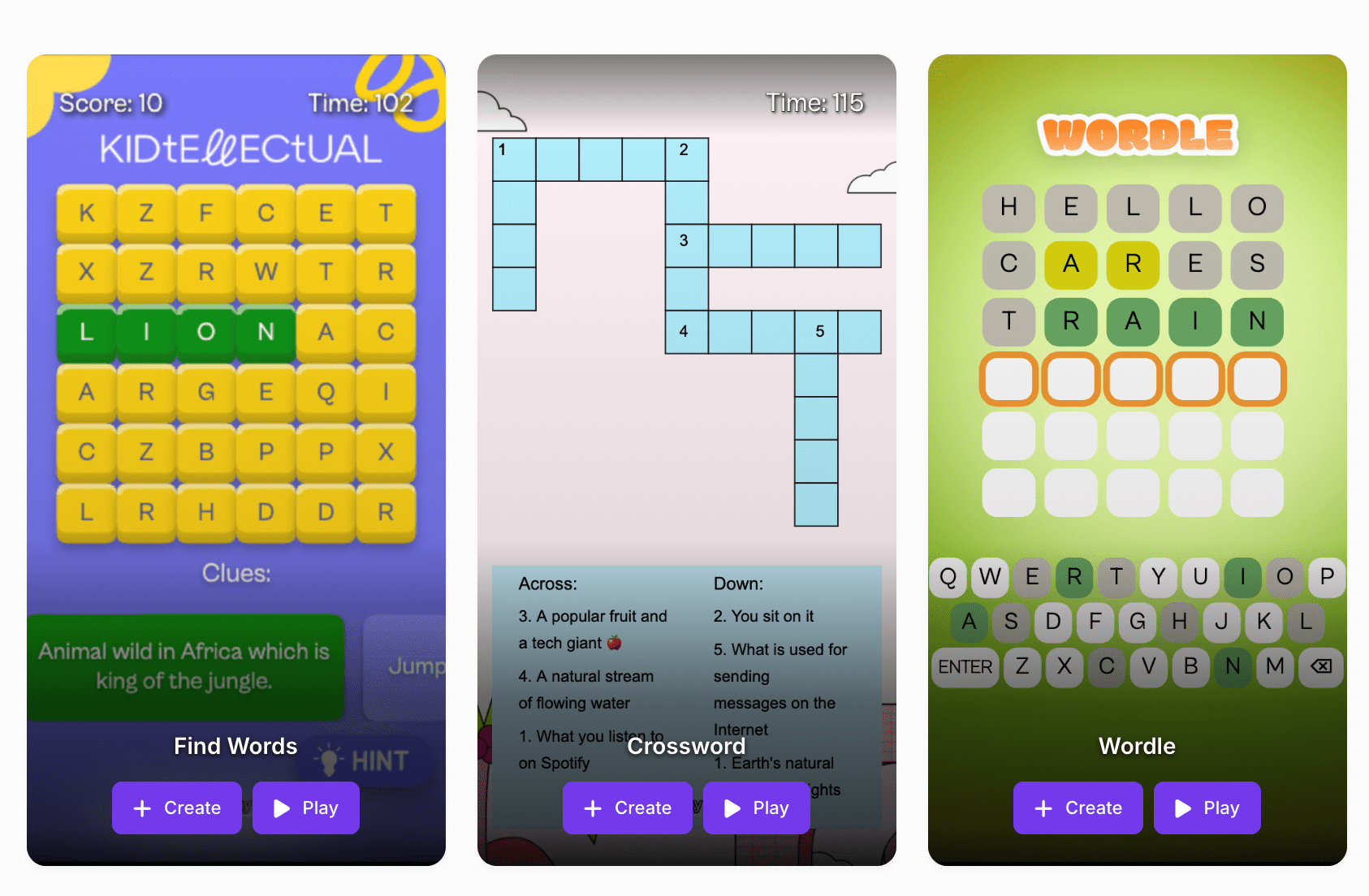

2. Investment Terms Crossword

Financial jargon can confuse many consumers, but crosswords make it simple and engaging to learn. A customized Playzo crossword could include terms like “inflation,” “dividend,” or “compound interest.” As users solve puzzles, they naturally improve their knowledge, while the brand gains longer session times and stronger customer relationships. This approach is particularly useful for financial educators and advisory firms aiming to boost brand credibility.

3. Spin the Wheel for Customer Rewards

Luck-based games are powerful in motivating users, especially for driving participation in promotions. Banks or wealth management platforms can use Spin the Wheel to offer discounts on loan processing fees, bonus reward points, or exclusive webinars on financial planning. This not only encourages immediate interaction but also strengthens loyalty by making financial benefits feel fun and accessible.

Suggested Image: Spin wheel with finance-related rewards like “Fee Waiver” or “Bonus Points”

4. Daily Finance Wordle Challenge

Building daily engagement is crucial for financial apps. A finance-themed Wordle can deliver this stickiness by challenging users with words like “asset,” “equity,” or “yield.” Customers return every day for a fresh challenge, strengthening brand recall while subtly learning finance vocabulary. This game is perfect for educators, banking apps, or fintech startups seeking daily user interactions.

5. Scratch Cards for Loan Offers & Discounts

Gamified surprises can drive conversions faster than static promotions. With Scratch Cards, banks can reveal limited-time loan discounts, free insurance top-ups, or cashback offers on transactions. Customers are more likely to redeem offers revealed through gamified interaction than passive emails. For finance marketers, this translates to both higher engagement and increased product uptake.

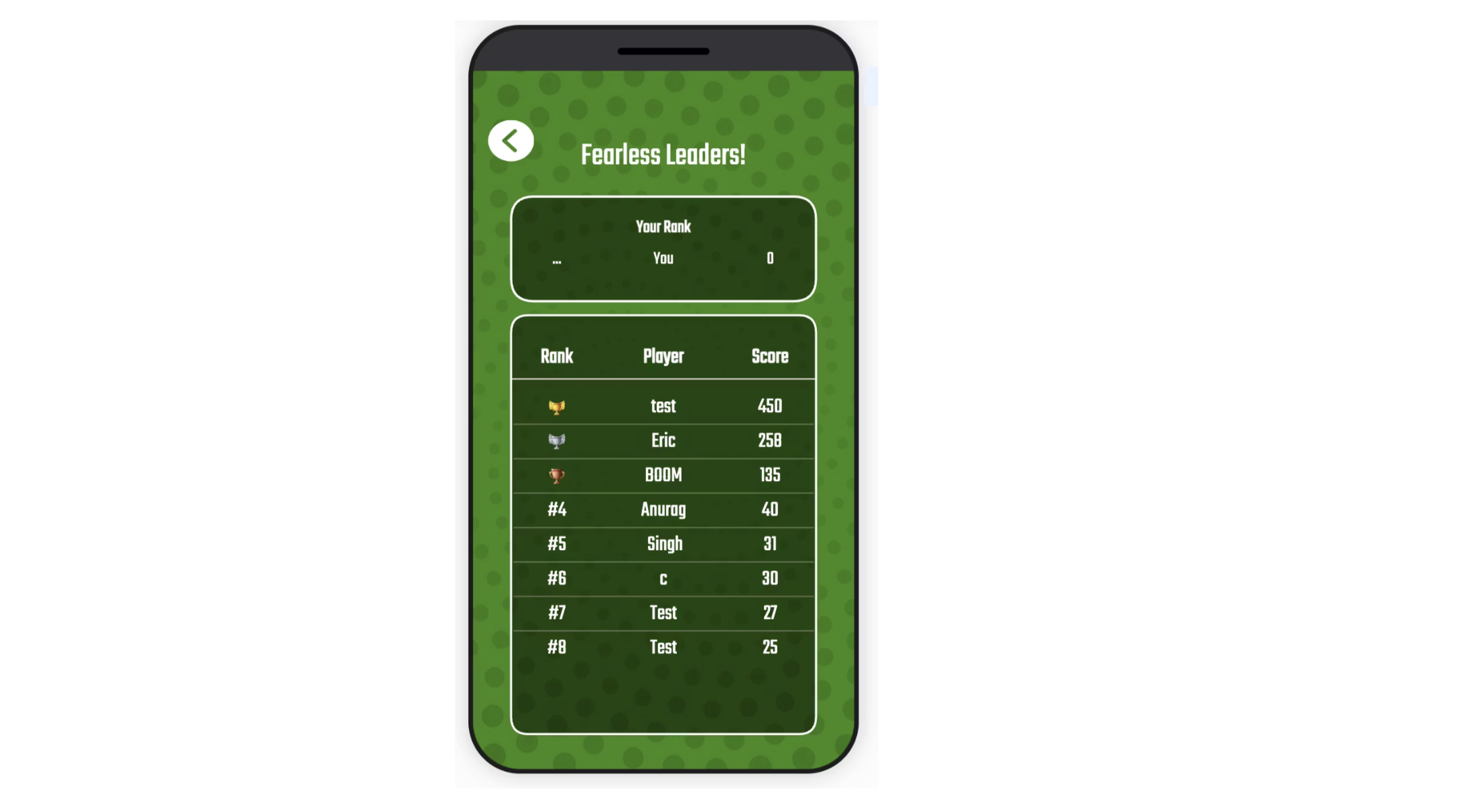

6. Leaderboards for Financial Challenges

Leaderboards add a social, competitive element to financial education. For example, a bank could launch a “Savings Month Challenge” where users track their daily savings habit and compete with others. Playzo enables leaderboard-driven gamified campaigns that not only motivate users through peer ranking but also promote community discussions about finance. This builds a sense of achievement and strengthens loyalty to the brand hosting it.

Conclusion

Finance doesn’t have to be boring or intimidating for customers. With Playzo, financial services can design interactive campaigns that educate, engage, and convert. From literacy-focused quizzes and puzzles to promotional spin wheels and scratch cards, gamification has the power to transform the way financial brands connect with their audiences. By choosing the right mix of these seven ideas, any finance organization can supercharge trust, loyalty, and customer engagement in 2025.

FAQ / People Also Ask

How can gamification help the finance industry?

Gamification simplifies complex financial topics, improves financial literacy, and motivates customers to engage with financial products through interactivity and rewards.

Which gamified games work best for banks?

Banks often benefit most from financial quizzes, investment crosswords, spin wheels for rewards, and scratch cards revealing product offers—all available within Playzo.

Can gamification improve financial education?

Yes, studies show that gamified approaches increase knowledge retention by up to 60%. Playzo’s quizzes and puzzles make learning finance more enjoyable and practical.

Is Playzo suitable for fintech startups?

Absolutely. Playzo’s no-code gamification platform enables startups to launch interactive finance campaigns quickly without needing developers, helping them capture leads and drive retention.